According to a recent report by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, there is a larger slowdown expected in home repair and remodeling projects. This is mainly due to high interest rates and a low supply of existing homes, which are expected to dampen activity in the housing market. The report forecasts a decline of 7.7% in annual owner expenditures for home updates and maintenance through the third quarter of 2024. Furthermore, homeowner concerns about the economy may also contribute to a decrease in remodeling plans. This projection is a significant increase in the slowdown compared to previous forecasts, indicating that 2024 may be a challenging year for home remodeling. However, with 24 million homes reaching their “prime remodeling years” by 2027 and favorable borrowing conditions for homeowners, a surge in remodeling and repair is expected in the future.

Home improvement spending expected to decrease at a moderate rate

When it comes to home improvement projects, there is some concerning news on the horizon. The Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University has projected a larger slowdown in home improvement spending than previously anticipated. They expect spending on home improvement projects and repairs to decrease at a “moderate rate” in the coming years. There are several factors contributing to this anticipated decrease in remodeling activity, including high interest rates, a low supply of existing homes, and homeowner concerns about the state of the economy.

High interest rates

One of the factors playing a role in the anticipated decrease in home improvement spending is high interest rates. The ongoing weakness in the housing market, caused by these high interest rates, is expected to have a direct impact on remodeling activity. Homeowners may be less inclined to take on major renovation projects if they are burdened with higher mortgage rates and increased borrowing costs.

Low supply of existing homes

Another contributing factor to the slowdown in remodeling activity is the low supply of existing homes. With fewer homes on the market, homeowners may be less likely to move and more likely to invest in remodeling their existing homes. However, the low supply of homes for sale could limit the number of homeowners who are able to embark on these remodeling projects, leading to a decrease in overall spending.

Homeowner concerns about the economy

Homeowner concerns about the health and direction of the broader economy may also dampen plans for remodeling projects. When economic uncertainty is looming, homeowners may be more cautious with their spending and choose to postpone or scale back on home improvement projects. This hesitation could contribute to a decrease in overall spending on remodeling and repair projects.

Impact of high interest rates on remodeling activity

High interest rates have a direct impact on remodeling activity. When interest rates are high, it becomes more expensive for homeowners to borrow money for renovation projects. This can deter homeowners from taking on larger, more costly projects, especially if they are concerned about their ability to afford the increased monthly payments associated with a higher interest rate. As a result, remodeling activity may slow down as homeowners opt for smaller, more affordable projects or choose to postpone their plans altogether.

This image is property of assets1.hbsdealer.com.

Effect of low supply of existing homes on home improvement projects

The low supply of existing homes can also have an effect on home improvement projects. With fewer homes on the market, homeowners may be more inclined to stay put and invest in remodeling their current homes. However, if the supply of homes is severely limited, it can make it more difficult for homeowners to find the right property for their needs. This can lead to a decrease in remodeling activity as homeowners are unable to find suitable homes to renovate.

Economic concerns influencing remodeling plans

Homeowner concerns about the economy can also influence remodeling plans. When there is uncertainty about the state of the economy, homeowners may be less willing to take on major renovation projects. They may be more cautious about using their savings or taking on debt if they are unsure about the stability of their financial situation. This hesitation can lead to a decrease in remodeling activity as homeowners choose to hold off on their plans until they feel more confident about the economic landscape.

This image is property of assets1.hbsdealer.com.

Latest Leading Indicator of Remodeling Activity (LIRA) projections

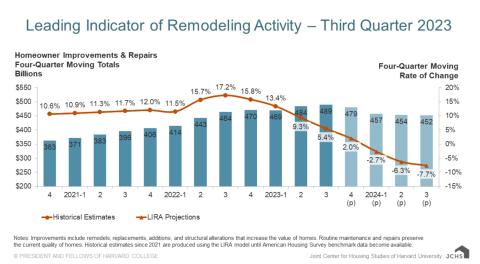

The latest Leading Indicator of Remodeling Activity (LIRA) projections provide insight into the expected decrease in home improvement spending. According to the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, annual owner expenditures for home updates and maintenance are forecasted to decline by 7.7% through the third quarter of 2024. This indicates a larger slowdown in spending than previously projected.

Comparison with previous LIRA forecast

The latest LIRA projections differ from the previous forecast released in July. In the previous forecast, the Joint Center for Housing Studies stated that year-over-year spending would shrink by 2.7% through the first quarter of the following year and by 5.9% through the second quarter. However, the latest projections indicate a more significant decrease in spending, with annual spending on improvements and repairs projected to fall from $489 billion to $452 billion over the coming four quarters.

This image is property of images.unsplash.com.

LIRA forecasts a decline in annual owner expenditures for home updates and maintenance

According to the latest Leading Indicator of Remodeling Activity (LIRA) projections, there is expected to be a decline in annual owner expenditures for home updates and maintenance. The Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University forecasts a decrease of 7.7% through the third quarter of 2024. This decline in spending reflects the challenging year anticipated for home remodeling in the near future.

Projected decline in spending from $489 billion to $452 billion

The projected decline in annual owner expenditures for home updates and maintenance is significant. The latest LIRA projections indicate that spending on home improvement projects and repairs is expected to fall from $489 billion to $452 billion over the coming four quarters. This decrease in spending reflects the larger slowdown in remodeling activity that is anticipated in the housing market.

This image is property of images.unsplash.com.

Remodeling and repair surge expected in a few years

While the outlook for home remodeling may be dim at present, there is some hope for the future. According to representatives from John Burns Research and Consulting, a remodeling and repair surge is expected to occur in a few years. By 2027, 24 million homes will reach their “prime remodeling years.” This means that a significant number of homeowners will have the financial means and motivation to undertake major renovation projects. Additionally, with 85% of homeowners currently locked into mortgage rates below 5% and an average equity of about $333,000, there is potential for increased borrowing and spending on remodeling projects.

Potential factors contributing to the surge

Several factors could contribute to the anticipated surge in remodeling and repair projects. The large number of homes reaching their prime remodeling years means that there will be a high demand for renovation services. Homeowners who have been holding off on remodeling projects may finally have the means to proceed. Additionally, the current low mortgage rates and high equity levels provide homeowners with the financial resources to invest in their homes. This combination of factors creates a favorable environment for a surge in remodeling and repair activity.

This image is property of images.unsplash.com.

Projected increase in spending with 24 million homes reaching prime remodeling years

As 24 million homes reach their prime remodeling years, there is expected to be a significant increase in remodeling and repair spending. With a large number of homeowners in a position to undertake major renovation projects, the demand for construction materials, labor, and services will likely skyrocket. This surge in spending has the potential to boost the home improvement industry and support economic growth.

Current state of remodeler confidence

The current state of remodeler confidence is a cause for concern. According to the National Association of Home Builders (NAHB), remodeler confidence decreased in the third quarter. The latest NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 65, falling three points compared to the previous quarter. This decline in confidence may be a reflection of the challenges facing the remodeling industry, including high interest rates, low supply of homes, and economic uncertainty.

Decrease in remodeler confidence in the third quarter

The decrease in remodeler confidence in the third quarter suggests growing uncertainty and caution within the industry. Remodelers may be more hesitant to take on projects or expand their businesses due to the challenges and uncertainties in the housing market. This decrease in confidence could have a further impact on remodeling activity and spending in the coming months.

NAHB/Westlake Royal Remodeling Market Index (RMI) readings

The NAHB/Westlake Royal Remodeling Market Index (RMI) provides valuable insight into the state of the remodeling industry. The latest readings indicate a decline in remodeler confidence, with the index posting a reading of 65 in the third quarter. This decrease in confidence suggests that remodelers are more cautious about the future, potentially leading to a slowdown in activity and spending.

Impact of supply constraints on existing-home sales

Supply constraints have a significant impact on existing-home sales. When the supply of homes is limited, it can create a highly competitive market, driving up prices and making it more challenging for buyers to find suitable properties. This can lead to a decrease in existing-home sales as potential buyers are priced out of the market or struggle to find available homes that meet their needs. The impact of supply constraints on existing-home sales can, in turn, affect the level of remodeling activity, as homeowners may be less likely to move and opt for renovation projects instead.

Decrease in existing-home sales in September

The impact of supply constraints on existing-home sales is evident in the decreased sales numbers for September. According to the National Association of Realtors, total housing inventory was down 8.1% from September of the previous year. The low supply of homes on the market is making it difficult for buyers to find suitable properties, leading to a decrease in existing-home sales. This decrease in sales can have a cascading effect on remodeling activity, as fewer homeowners may be motivated to undertake renovation projects if they are unable to sell their current homes.

Analysis of the building products market outlook

An analysis of the building products market outlook reveals important trends and insights. One notable trend is the expectation for a continued trend of smaller-home size. As the demand for more affordable housing increases, builders are responding by constructing smaller homes. This shift in market demand impacts the remodeling industry, as homeowners may be more focused on maximizing the functionality and value of their existing smaller homes rather than undertaking larger renovation projects.

Expectation for continued trend of smaller-home size

The expectation for a continued trend of smaller-home size is driven by market demand and affordability concerns. As housing prices continue to rise, many homeowners are looking for more affordable options. Smaller homes are often more affordable, making them an attractive choice for budget-conscious buyers. This trend in smaller-home size has implications for the remodeling industry, as homeowners may prioritize renovations that maximize space and functionality in their smaller dwellings.

Conclusion on the expected larger slowdown in repair and remodeling

In conclusion, there is an expected larger slowdown in repair and remodeling activities in the coming years. Factors such as high interest rates, a low supply of existing homes, and homeowner concerns about the economy are driving this anticipated decrease in spending. The latest Leading Indicator of Remodeling Activity (LIRA) projections suggest a decline in annual owner expenditures for home updates and maintenance. However, there is hope for a surge in remodeling and repair projects in the future, as 24 million homes reach their prime remodeling years. The current state of remodeler confidence and the impact of supply constraints on existing-home sales further contribute to the challenging environment for the home improvement industry. Overall, it is anticipated that the coming years will be a challenging period for home remodeling.